Gamblers understand the concept of win some, lose some. But the IRS? It prefers exact numbers. Specifically, your tax return should reflect your total year's gambling winnings – from the big blackjack score to the smaller fantasy football payout. That's because you're required to report each stroke of luck as taxable income — big or small, buddy or casino.

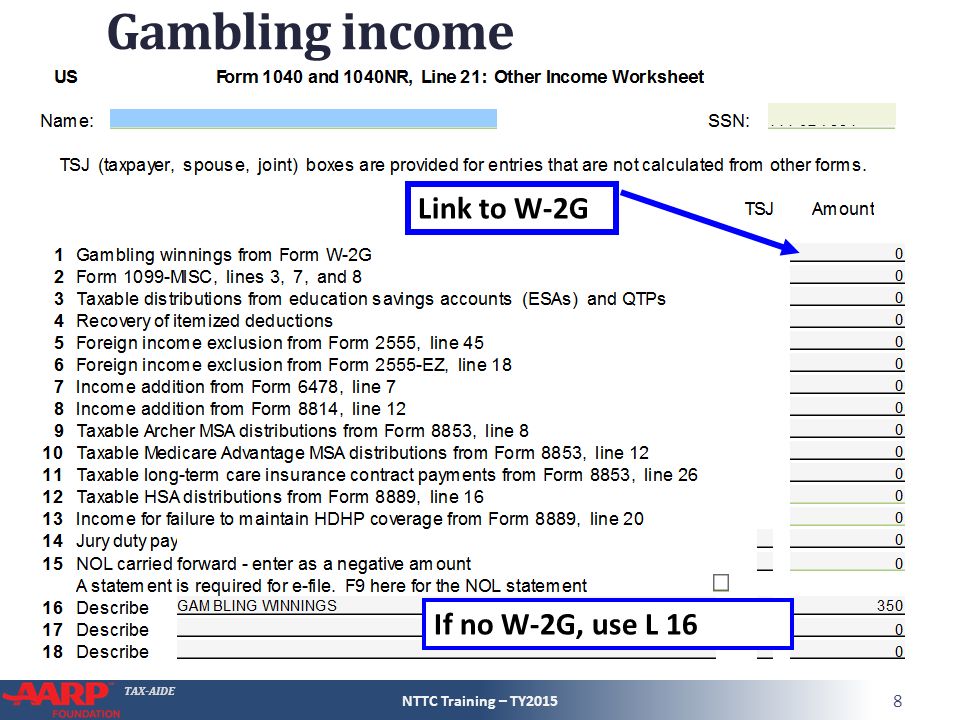

Both cash and the value of prizes are considered 'other income' on your Form 1040.If you score big, you might even receive a Form W-2G reporting your winnings. The tax code requires institutions that offer gambling to issue Forms W-2G if you win. $600 or more on a horse race (if the win pays at least 300 times the wager amount). Depending on the size of your win, you may receive a Form W-2G, Certain Gambling Winnings and may have federal income taxes withheld from your prize by the gambling establishment. Gambling winnings are unique because you can also deduct your gambling losses and certain other expenses, but only in specific circumstances (see our article about this). Other income on Form 1040 refers to income that isn't assigned a specific line on a 1040 tax return or Schedule 1 form. You typically have to report other income if you receive money or goods that aren't included on a W-2 or most 1099s. Canceled debts and foreign income are typically reported as other income. In Drake18, the amount of gambling winnings flows to line 21 of Schedule 1 and then the sum of lines 10-21 flows to Form 1040, line 6. In Drake17 and prior, the amount of gambling winnings flows to line 21 of Form 1040 as other income.

If you itemize your deductions, you can offset your winnings by writing off your gambling losses.

It may sound complicated, but TaxAct will walk you through the entire process, start to finish. That way, you leave nothing on the table.

Report Gambling Winnings On 1040

How much can I deduct in gambling losses?

You can report as much as you lost in 2019 , but you cannot deduct more than you won. And you can only do this if you're itemizing your deductions. If you're taking the standard deduction, you aren't eligible to deduct your gambling losses on your tax return, but you are still required to report all of your winnings.

Where do I file this on my tax forms?

Let's say you took two trips to Vegas this year. In Trip A, you won $6,000 in poker. In the Trip B, you lost $8,000. You must list each individually, with the winnings noted on your return as taxable income and the loss as an itemized deduction in Schedule A. In this instance, you won't owe tax on your winnings because your total loss is greater than your total win by $2,000. However, you do not get to deduct that net $2,000 loss, only the first $6,000.

Now, let's flip those numbers. Say in Trip A, you won $8,000 in poker. In Trip B, you lost $6,000. You'll report the $8,000 win on your return, the $6,000 loss deduction on Schedule A, and still owe taxes on the remaining $2,000 of your winnings.

What's a W-2G? And should I have one?

Wikipedia poker probability. A W-2G is an official withholding document; it's typically issued by a casino or other professional gaming organization. You may receive a W-2G onsite when your payout is issued. Or, you may receive one in the mail after the fact. Gaming centers must issue W-2Gs by January 31. When they send yours, they also shoot a copy to the IRS, so don't roll the dice: report those winnings as taxable income.

Where Do You Put Gambling Winnings On 1040 2020

Don't expect to get a W-2G for the $6 you won playing the Judge Judy slot machine. Withholding documents are triggered by amount of win and type of game played.

Expect to receive a W-2G tax form if you won:

- $1,200 or more on slots or bingo

- $1,500 or more on keno

- $5,000 or more in poker

- $600 or more on other games, but only if the payout is at least 300 times your wager

Tip: Withholding only applies to your net winnings, which is your payout minus your initial wager.

What kinds of records should I keep?

Keep a journal with lists, including: each place you've gambled; the day and time; who was with you; and how much you bet, won, and lost. You should also keep receipts, payout slips, wagering tickets, bank withdrawal records, and statements of actual winnings. You may also write off travel expenses associated with loss, so hang on to airfare receipts.

Use TaxAct to file your gambling wins and losses. We'll help you find every advantage you're owed – guaranteed.

More to explore:

The information in this article is up to date through tax year 2019 (taxes filed in 2020).

An estimated 57 million to 75 million people join fantasy football leagues through hosting sites like Draftkings, Yahoo!, ESPN and FanDuel every year. Just like the NFL draft, a fantasy draft allows you to pick and choose players from different positions and teams to put together the best team possible. Dedicated members know if you draft the right teams, you could win big by the end of the season.

But did you also know that you are accountable for reporting those earnings to the IRS?

Do I have to pay taxes on fantasy sports winnings?

Possibly, yes. The income from fantasy sports is treated just like any other cash prize or gambling win. If your net profit from playing fantasy football is $600 or more, you will need to report your winnings.

How do I report fantasy sports winnings?

Winnings are reported as 'other income' on your tax return. The major leagues know to send you Form 1099-MISC, which has all the information you'll need. They'll send the same information to the IRS about your net profit, so make sure to report your winnings on your tax return. The IRS will know if you did not.

What should I do if I didn't get a 1099-MISC?

If you don't receive Form 1099-MISC from your fantasy sports host site, it does not mean you are free from tax liability. You will still be accountable for your income if it is over $600. It's always a good idea to keep track of your winnings to report them accurately on your tax return.

Are there tax deductions for fantasy sports?

Currently, there are no tax deductions for fantasy league winnings. Before 2018, you could write off the entrance fees under miscellaneous deductions. But the tax laws changed under the Tax Cuts and Jobs Act and got rid of miscellaneous deductions like this one. Learn more about it here.

Can I claim gambling losses for fantasy sports?

The general rule for claiming gambling losses is that you can never deduct more for losses than you report for income. So, if you win $1,000 and lose $1,500 in another league, your deduction is limited to just $1,000. You can't deduct your losses without reporting your wins. Also note that to report gambling losses, you must choose to itemize your deductions instead of taking the standard deduction.

Where Are Gambling Winnings Reported

Need a coach for filing your income taxes? TaxSlayer makes filing simple and easy. We'll ask the right questions to help you get the maximum refund when you file.